SSS Salary Loan is a program of our Social Security System that allows members to borrow a portion of their contribution for a short-term cash need.

It is the most availed loan program of the SSS. Between January 2019 to August 2019, SSS released more than Php26.33 billion worth of salary loans.

Of this figure, 1.16 million employed members availed of the said program followed by 104,000 voluntary members.

OFWs and seafarer member-borrowers count at 12,411 and self-employed contributors number around 13, 724.

Many Filipino seafarers and OFWs use this service and receive financial assistance from SSS, especially during extended vacations.

What is the Social Security System?

Social Security System or the SSS is a government-run social insurance program. Workers or members pay into the program and Social Security will give them protection through cash incentives.

Essentially, SSS emphasizes the value of work, save, invest, and prosper.

It aims to promote social justice through savings and ensure meaningful social security protection for members and their beneficiaries. This includes disability, sickness, maternity, old age, death, and other contingencies resulting in loss of income or financial burden.

SSS members can avail of maternity, sickness, disability, retirement, funeral, and death benefits. Additionally, they allow qualified members to take up housing, business, educational, and salary loans which we will discuss here.

What is a salary loan?

A salary loan is a cash loan granted to an employed, currently- paying self-employed, or voluntary member. It is intended to meet the member’s short-term credit needs.

Seafarers who are actively sailing are also actively paying their SSS contribution. To verify if your company is really paying for your contributions, you can check your account online using their website or you can proceed to the nearest SSS Branch.

Who Can Apply for an SSS Salary Loan?

In order to avail of the benefits, a person must first become a member. To become a member, he or she must enroll in social security and fulfill the obligations of paying monthly contributions.

These are the categories of people who are required to join this program.

- Employed

- Self-employed

- Voluntary Member

- Non-working Spouse

- Seafarers

- Overseas Filipino Workers

- Household Employee and Kasambahay

Seafarers are obliged to pay for their SSS contributions and this is made through their employers or manning agencies.

Additionally, members must have a registered SSS account online as they impose a “No web registration, no salary loan” policy. This is important since it speeds up the processing of your application.

Eligibility Requirements

Even if you’re already registered, you need to satisfy a few requirements in order to avail of its services including the salary loan.

Here are the eligibility requirements for members.

- Must be currently employed, currently contributing self-employed, or voluntary member.

- Must be updated in the payment of contributions OF AT LEAST six contributions for the last 12 months.

- Member-borrower whose employer must be updated in the payment of contributions.

- The member-borrower has not been granted the final benefit, i.e., total permanent disability, retirement, and death

- Must be under sixty-five (65) years of age at the time of application

- Has not been disqualified due to fraud committed against the SSS.

There are two types of loans you can avail of depending on your contribution.

- For a one-month loan, the member-borrower must have thirty-six (36)posted monthly contributions. In addition, six (6) contributions should be within the last twelve (12) months prior to the month of filing of application.

- For a two-month loan, the member-borrower must have seventy-two (72)posted monthly contributions. In addition, six (6) contributions should be within the last twelve (12) months prior to the month of filing of application.

How much can you apply for a Salary Loan?

This is probably the most asked question I have heard from my fellow seafarers whenever they ask me about the SSS Salary Loan.

Now that we are eligible, it’s time to check how much we can apply for it.

Remember that there are different categories of members. Their contributions also vary so therefore, so does the amount of loan you can get.

But here’s a general rule to see that.

Loan Details

A one-month salary loan is equivalent to the average of the member-borrower’s latest posted 12 Monthly Salary Credits (MSCs), or the amount applied for, whichever is lower.

A two-month salary loan is equivalent to twice the average of the member-borrower’s latest posted 12 MSCs, rounded to the following higher monthly salary credit, or amount applied for, whichever is lower.

The net amount of the loan shall be the difference between the approved loan amount and all outstanding balances of short-term member loans. There is, however, a 1% processing fee that will be deducted.

My first loan granted a maximum amount of Php16,000.00. The amount deposited to my bank account was Php15,840.00 after deducting 1% from the total loan value.

We must also pay it within 24 months but I did it for less than that time. However, many of my fellow seafarers ignore this part after getting the loan. They usually forget about it once they get the money and then complain a few years after that it’s out of control.

Remember, there is a very low diminishing interest rate of 10% per annum for our salary loan. If you fail to pay it, there is also a penalty of 1% interest rate every month.

Monthly Salary Credits (MSC)

To understand more about Monthly Salary Credits, take a look at a picture taken from the SSS Official Facebook Page.

Every salary bracket has a corresponding Monthly Salary Credits.

So for example, for a one-month salary loan, take the average of your latest 12-month MSC. That’s the amount you can apply for.

For the two-month salary loan, it’s similar to the latter but once you arrive at the average, you have to multiply it by two since it’s twice the average.

But really, you don’t need to worry about the computation for that. When applying for the SSS salary loan online, you will immediately see the available amount you can get.

IDs Accepted

SSS digitized ID or E-6 (acknowledgment stub) with any two valid IDs below.

- Unexpired Driver’s License

- Professional Regulation Commission (PRC) ID card

- Passport

- Seaman’s Book (SIRB)

- Unified Multi-Purpose ID (UMID) Card

- Social Security (SS) Card

- Postal ID

- School or Company ID

- Tax Identification Number (TIN) card

- Membership cards issued by private companies

- Overseas Worker Welfare Administration card

- Senior Citizens card

- Voter’s Identification card/Affidavit/Certificate of Registration

- ATM card

- Etc.

There are a lot more secondary IDs listed but I will only post the common ones since seafarers have their primary IDs ready (SIRB and Passport).

Steps in Applying for the SSS Salary Loan Online

Now that we know the nitty-gritty requirements and a few technical jargon, it’s time to hit their website and apply for the salary loan.

Assuming you already registered to their online platform, here’s what you got to do.

1. Go to the SSS website and log in as a member.

Their My.SSS website is very user-friendly and straightforward. Everyone should be able to use it with ease.

On the right side of the screen, click on Member. A new window will open up. Enter your User ID and Password.

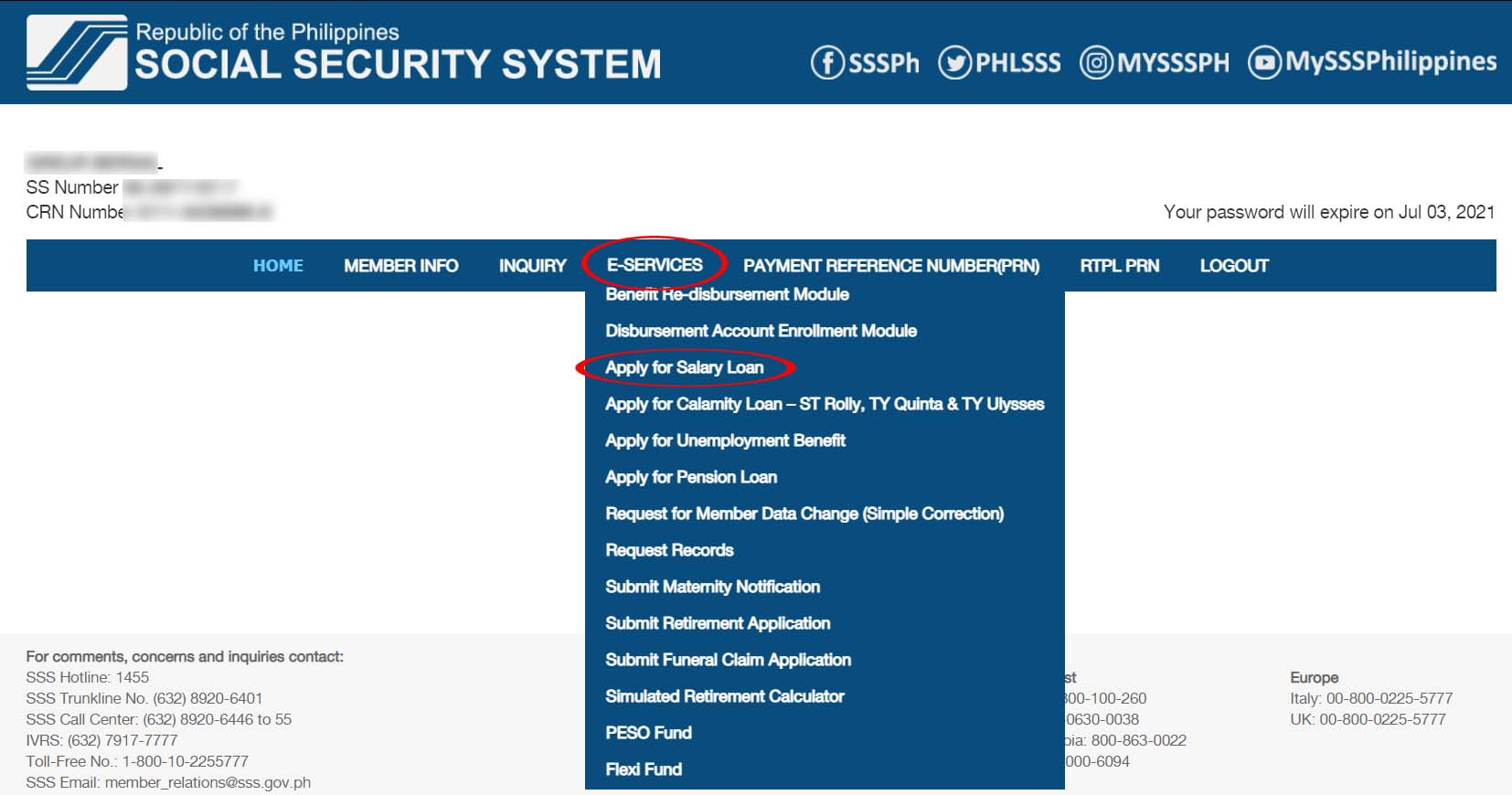

2. Loans and Apply for Salary Loan.

Upon hitting those tabs, you will be taken into this window. You will see all the necessary details including your personal data and contact info.

Additionally, you will also see your current employer and their SSS ID.

Important: There are updates on the layout of SSS websites that may slightly differ here since I made my loan application during my vacation a few years ago. However, the steps and processes are still the same or highly similar.

Now let’s elaborate a little bit of that image below.

If you want to change or update your contact information, Click on the blue link with the word here encircled. It will take you to another window where you can make necessary updates or just double-check the details there.

Under Loanable Amount, click on the drop-down arrow and you will see how much your maximum and minimum loan can be.

Electronic Disbursement

As for your electronic disbursement bank, you can choose among the Red Arrows if which one is more convenient for you.

In my case, I already applied for a Cash Card during my first salary loan last 2018. It was still a face-to-face application.

Do take note of the reminders posted and tick the check box to agree with the Terms and Conditions.

Hit Proceed to go to the next step.

3. Certification, Agreement, and Promissory Note

We are almost finished with our application. Upon clicking Proceed from the previous step, this will show up.

Here you will see the net amount you will get after 1% deductions. It will also show which bank or account your loan will be credited including your certifying employer’s details.

Read carefully the Certification, Agreement, and Promissory Note and click Submit if you are confident you understand them.

4. Awaiting Certification from Employer

SSS now receives your loan application. An email is also sent to your employer for them to certify your request.

The best thing to do here is to inform your manning agency about your intention. You can even do this in advance even before you apply for a loan to save time.

Your application is valid for three days only. If your employer does not submit a certification during that time period, it will expire and you have to redo steps 1 to 4 again.

SSS will also send a system-generated email to your registered email address. If your loan expires without being certified, you will also receive an email regarding that.

What if your company refuses to give you a certification?

In other words, what if they never approve your certification for the loan? What can we do about this?

I received messages and comments regarding this and it’s frustrating that after paying our monthly contribution and meeting the eligibility requirements, our shipping agency will just scrap our loan by not giving us the certification.

Their main reason is that we are “no longer employed by the company” since our contract ended with them.

I contacted SSS about this and their reply was,

The certification process is under the discretion of your employer for the loan to continuously progress in its processing.

In short, there’s nothing we can do and we are at the mercy of our employer. However, if this still plays out, we should be able to apply for a salary loan when we are onboard.

Surely they will approve it since we are employed by then.

Other than that, we have to make our pleas louder so that this will come to light and the higher-ups may notice it and take action.

5. Loan Approved!

You will receive an SMS and email confirmation once SSS and your employer approves your loan.

The loan should be credited really fast! I re-applied on the 20th of January, got certified on the 22nd, and received my loan on the 25th which is Monday.

Prior to that, I informed my company and they were happy to assist me with the certification.

The good thing about SSS Salary Loan today is that it’s so much easier and faster than before. On my first application way back in 2018, I spent three days before it was processed and waited a week for its release.

We all know how cramped and long the lines are in government institutions. If you’re a seafarer, I think you’re also fed up with long lines especially here in the country.

But with the SSS Salary Loan Online application, you don’t even need to go out of your house, and it’s much faster too.

May the winds be in your favor.

Our employer never approve because we are contractual as seafarer. They say we are not regular that is why they never certify. What action we do for availing this kind of loan?

Sad to say but after contacting SSS, they said that the certification process is at the discretion of your manning agency.

the salary loan for seafarers are quite tricky. I have paid a month of voluntary contribution to avoid any lapse in contribution after my contract. Then I decided to avail of the salary loan. The process is quite repugnant. One will have to wait for 6 months before we can avail of the salary loan to suffice their ridiculous requirement of one must have atleast 6 mos contribution under his/her current membership status. Just F* ridiculous.

Hello. May I ask how long are you a contributor to SSS? If you have at least 6 months contributions for the last 12 months, taking out a loan shouldn’t be a problem. You may have to check your account and see if your contributions are up to date during those times when you are on board.

I have updated payment in the last 9 months, now i am finished contract with my manning agency and decided to pay voluntarily for the next 3 months pf my vacation, can i avail of the salary loan?

You can avail of the salary loan as long as you meet the eligibility requirements. However, there are some manning agencies that won’t approve your certification. Inform your manning agency first and ask them if they will certify your SSS loan.

is employer are liable to approved the loan application even if the seafarers is already end of contract? Or is it ok to reject the application

Per my experience, I still needed my employer’s approval (through a certification) in order for SSS to release my loan when I was on the second month of my vacation. Without it, I could not avail of their salary loan.

You have the option to reject the application but the seaman will not be able to avail of their salary loan.

Parang naging kasalanan ko pa ngayun na naging seaman ako dahil hindi ako makapag salary loan dahil sa mga HINIHINGI NG SSS NG “RIDICULOUS REQUIREMENTS” pera namin yan bakit hindi namin magalaw or mahiram,mahiya naman kayo SSS hindi komo seaman na kami hindi na namin kailangang mag loan, contribution namin yan,tagapamahala lang kayo, bakit niyo kami pinapahihirapan,mahiya naman kayo,kahit konti lang please

What if the employer dont like to approve your calamitu loan due u have exiting balance in salary, does they power to this approve the calamity loan.

You have to settle your remaining balance with your employer first before they approve your calamity loan. Neither you, nor the SSS can do anything to release your loan unless your employer approves.